The Hidden Tax Trap in Your Accident Insurance Plan

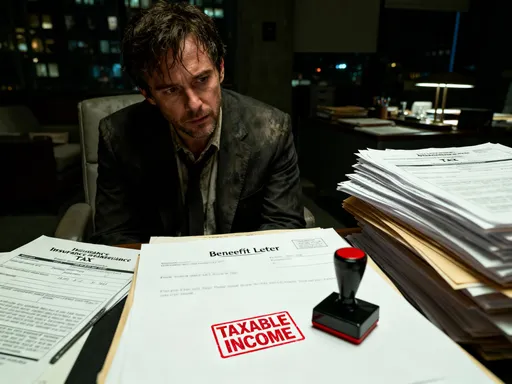

You buy accident insurance to feel safe—but what if it secretly costs you more at tax time? I learned this the hard way after a small claim triggered an unexpected tax bill. What seemed like a straightforward payout came with compliance headaches I never saw coming. Turns out, not all insurance benefits are tax-free, and mistakes can flag your return. Let me walk you through the real risks hiding in plain sight—so you don’t get burned like I did.

The Promise of Accident Insurance – And the Fine Print Nobody Reads

Accident insurance is often marketed as a straightforward financial safeguard. It promises fast, lump-sum payments when unexpected injuries occur—whether it’s a broken arm from a fall or a hospital stay after a car crash. For many families, especially those managing tight budgets, these plans offer peace of mind. The idea is simple: pay a small monthly premium and receive a significant payout if disaster strikes. But beneath this reassuring surface lies a complex reality that few take the time to understand. The promise of tax-free benefits, often implied in brochures and sales pitches, is not a guarantee. In fact, whether your payout is taxable depends heavily on how the policy was funded and who paid the premiums.

This misunderstanding stems from a common assumption: all insurance payouts are automatically tax-exempt. While life insurance proceeds, for example, are generally not taxed, accident insurance does not always follow the same rule. The Internal Revenue Service (IRS) has specific criteria for determining whether a benefit qualifies as non-taxable income. If your employer contributes to your premium or if the plan is tied to a pre-tax benefits package, the IRS may view your payout as taxable compensation. This means that even though you did not receive the money as regular wages, it could still be treated like income for tax purposes. The fine print in many policies rarely highlights this distinction, leaving policyholders unaware until they receive a 1099 form or face questions during tax season.

Consider a real-world example: a mother of two purchases an accident insurance plan through her workplace, believing it to be a fully tax-free benefit. After slipping on ice and requiring surgery, she files a claim and receives a $7,500 payout. She uses the money to cover medical deductibles and lost wages during recovery. Come April, however, she discovers that the amount is included in her taxable income. Confused and frustrated, she contacts both her insurer and tax preparer, only to learn that because her employer paid 60% of the premium using pre-tax dollars, the entire benefit became taxable under IRS rules. This is not a rare case. Thousands of individuals each year face similar surprises because they trusted the marketing over the mechanics.

The gap between expectation and reality grows wider when insurance providers emphasize speed and simplicity while downplaying financial implications. Sales materials often use phrases like “tax-free cash when you need it” without clarifying the conditions. As a result, consumers make decisions based on incomplete information. This lack of transparency isn’t always intentional, but its consequences are real. To avoid falling into this trap, it’s essential to read policy documents carefully, ask detailed questions during enrollment, and consult a tax professional when in doubt. The safety net you’re building should protect your finances—not expose them to unexpected liabilities.

When “Tax-Free” Isn’t: The Compliance Blind Spot

The belief that insurance money is always tax-free is one of the most persistent myths in personal finance. For many, the idea that a payout meant to cover medical bills or lost income could be subject to taxation feels counterintuitive. Yet, IRS guidelines make a clear distinction based on how the policy was financed. Most personal accident insurance policies—those purchased independently and paid for entirely with after-tax dollars—do result in non-taxable benefits. However, this protection evaporates when premiums are subsidized, deducted from pre-tax income, or included in an employer-sponsored package. In such cases, the IRS views the benefit as a form of deferred compensation, making it subject to federal income tax.

This compliance blind spot catches even careful taxpayers off guard. Many assume that as long as the payout amount isn’t large, it won’t attract attention. But the IRS doesn’t judge by size—it judges by source. A $2,000 claim from a pre-tax funded plan is just as reportable as a $20,000 one. What makes this particularly risky is the lack of automatic notification. Unlike wages, which come with W-2 forms, or interest income, which generates 1099-INTs, accident insurance payouts don’t always come with clear tax documentation. Some insurers issue 1099-MISC or 1099-NEC forms only for larger amounts, leaving smaller payouts unreported—and filers unknowingly underreporting income.

The consequences can be severe. An unreported taxable benefit, even if unintentional, may trigger an audit, lead to back taxes, or result in penalties and interest. The IRS uses third-party reporting systems to cross-check income, and discrepancies between what you report and what employers or insurers report can raise red flags. One taxpayer, a school administrator in Ohio, filed her return normally after receiving a $4,000 payout for a home injury. She assumed the amount was tax-free because it was for medical recovery. Two years later, she received a notice from the IRS demanding additional tax payment plus a 20% accuracy-related penalty. The reason? Her employer had reported the premium contributions as pre-tax, making the benefit taxable—and her omission, even if innocent, was still a violation of tax law.

Understanding IRS guidelines doesn’t require a law degree, but it does require attention. Section 104(a)(2) of the Internal Revenue Code states that amounts received under accident or health insurance for personal injuries or sickness are excluded from gross income only if the premiums were paid with after-tax dollars. This single rule determines whether your benefit is safe from taxation. Yet, most policyholders never see this code cited in their materials. The takeaway is clear: tax compliance isn’t just about filing correctly—it’s about understanding the structure of your benefits before a claim ever occurs. Being proactive now can prevent costly corrections later.

Employer-Provided Coverage: A Double-Edged Sword

Employer-sponsored accident insurance is often presented as a valuable perk—a no-cost or low-cost way to gain extra protection. For employees, especially those without access to robust health plans, these policies seem like a win. But the reality is more complicated. When an employer pays part or all of the premium using pre-tax dollars, the tax treatment of any future payout changes dramatically. What feels like a benefit today could become a tax obligation tomorrow. This duality makes employer-provided coverage a double-edged sword: it increases financial security in the short term but introduces hidden risks in the long term.

To illustrate, consider two employees at the same company, both covered under the same group accident insurance plan and both suffering identical injuries. Employee A pays their entire premium through payroll deductions using after-tax income. When they file a claim for a $10,000 benefit to cover surgery and rehabilitation, the full amount is tax-free. Employee B, however, has their premium partially paid by the employer, with the remainder deducted from their paycheck before taxes. When Employee B receives the same $10,000 payout, the entire amount is considered taxable income. Why? Because the presence of pre-tax funding—even if only for a portion of the premium—taints the entire benefit under IRS rules.

This scenario isn’t theoretical. It plays out across industries, from manufacturing to education, where employers offer supplemental insurance as part of a broader benefits package. The inconsistency in tax outcomes often confuses workers, who assume fairness in treatment. But the IRS does not operate on fairness—it operates on rules. And the rule is clear: if any part of the premium was paid with pre-tax funds, the benefit is fully taxable. There is no proportional exemption. This all-or-nothing approach means that even a 1% employer contribution can turn an otherwise tax-free payout into taxable income.

The implications go beyond a single tax year. Taxable benefits increase your adjusted gross income (AGI), which can affect eligibility for other financial programs, such as premium tax credits, student loan repayment plans, or Medicaid. A seemingly small payout could push a household into a higher income bracket, reducing or eliminating certain subsidies. For families already managing financial strain, this ripple effect can be significant. The lesson is not to reject employer-sponsored plans—but to understand them. Ask HR for a breakdown of how premiums are funded. Request documentation showing whether contributions are made with pre-tax or after-tax dollars. This information is critical for accurate tax planning and long-term financial health.

Record-Keeping: The Silent Shield Against Audit Risk

When it comes to tax compliance, documentation is everything. Yet, most accident insurance policyholders keep only the most basic records—usually just the initial policy agreement and perhaps a copy of a claim form. Few maintain a complete file of premium payments, employer contribution statements, or plan summaries. This lack of organization becomes a serious liability when tax season arrives or, worse, when the IRS initiates an inquiry. Without proper records, proving that your benefits should be tax-free becomes extremely difficult, even if you’re in the right.

Imagine receiving a letter from the IRS questioning the tax treatment of your $8,000 accident payout. You believe it’s tax-free because you paid the premiums yourself. But without proof—such as bank statements showing after-tax deductions or a signed plan document confirming funding sources—you have little defense. The burden of proof lies with the taxpayer, not the IRS. In such cases, reconstructed records are often insufficient. The agency requires contemporaneous documentation—evidence that existed at the time the payments were made. This is why a systematic approach to record-keeping is not just helpful—it’s essential.

A practical system starts with organizing all insurance-related documents in a dedicated folder, either physical or digital. Include the policy contract, enrollment forms, summary plan descriptions, and any correspondence with the insurer or employer. For each premium payment, save proof of transaction—pay stubs that show deductions, bank transfers, or receipts. If your employer contributes, request an annual statement confirming the tax status of those contributions. Update this file every year, especially after open enrollment or policy changes. Treat it like any other financial record, because that’s exactly what it is.

Good record-keeping does more than protect against audits. It streamlines tax preparation, reduces stress, and gives you confidence in your filings. It also strengthens your position if you ever need to appeal a decision or clarify your status with a tax professional. In an era of increasing IRS scrutiny and automated compliance checks, having a well-documented history is one of the most effective ways to avoid unnecessary complications. The time invested in organization today can save hours of stress—and potentially thousands in penalties—down the road.

Coordination with Other Benefits: Where Conflicts Multiply

Accident insurance rarely operates in isolation. Most people hold multiple layers of protection—health insurance, disability coverage, workers’ compensation, and health savings accounts (HSAs). While this layered approach makes sense for risk management, it can create unintended tax consequences when benefits overlap. The IRS has strict rules about double-dipping, meaning you cannot claim tax-free treatment for the same expense across multiple tax-advantaged accounts or insurance payouts. When accident benefits are used to cover costs already reimbursed by another plan, the tax status of the funds can change.

Consider a worker who suffers a back injury on the job. They receive $5,000 from their accident insurance policy, $10,000 in workers’ comp payments, and have $3,000 in medical bills covered by their HSA. If the accident insurance payout is used to repay the HSA for those same medical expenses, the IRS may view the reimbursement as taxable income. Why? Because HSA distributions for qualified medical expenses are tax-free only if they haven’t already been covered by insurance. Using accident benefits to “repay” the HSA creates a circular transaction that violates this principle. The result? A portion of what seemed like tax-free money becomes taxable.

Similarly, disability income and accident benefits can conflict. If both provide payments for lost wages, the IRS may treat the accident payout as a substitute for income—especially if the policy language describes it as compensation for lost earnings. In such cases, even if the premiums were paid with after-tax dollars, the nature of the payout could still trigger taxation. This is why reading the policy’s definition of benefits is crucial. Phrases like “income replacement” or “wage continuation” carry different tax implications than “lump-sum payment for injury.”

To avoid these conflicts, coordinate benefits carefully. Before filing a claim, review how other plans will respond. Consult your benefits administrator or tax advisor to ensure your use of funds complies with IRS rules. In some cases, adjusting how you allocate payouts—using accident benefits for non-medical costs like home modifications or transportation—can preserve the tax-free status of other accounts. The goal is not to eliminate coverage but to use it strategically, ensuring each dollar serves its purpose without triggering unintended tax events.

Common Misconceptions That Lead to Costly Errors

Myths about insurance and taxes are widespread, and they often sound logical—until they’re tested against IRS regulations. One of the most dangerous beliefs is that “all insurance money is tax-free.” This oversimplification leads people to assume safety where none exists. Another common myth is that “small claims don’t matter to the IRS.” In reality, there is no minimum threshold for reporting taxable income. Even a $500 payout from a pre-tax funded plan must be included in gross income. The IRS doesn’t grade on a curve—any unreported income, regardless of size, can lead to penalties.

Another misconception is that “the insurer handles the paperwork.” While some companies issue 1099 forms, many do not—especially for policies outside the traditional health or retirement categories. Relying on the insurer to report your income is risky. You are ultimately responsible for accurate reporting, even if no form is sent. A third myth is that “if I didn’t receive cash, it’s not income.” But non-cash benefits, such as direct payments to providers, are still considered income if they are taxable. The form of delivery doesn’t change the tax treatment.

A fourth myth is that “my tax preparer will catch it.” While professionals can help, they depend on the information you provide. If you don’t disclose the payout or misunderstand its nature, even an experienced preparer may miss the issue. Finally, some believe that “once the claim is paid, I’m done.” But tax obligations can surface years later, especially if the IRS discovers discrepancies through third-party reporting. Each of these myths has led to real consequences: underpayment penalties, audit notices, delayed refunds, and in some cases, ongoing tax debt.

The cost of assumptions is high. Taking the time to verify facts, read policy language, and consult a tax advisor—even for small claims—can prevent these errors. Financial literacy isn’t just about investing or budgeting; it’s about understanding how different systems interact. In the case of accident insurance, a few minutes of due diligence can save hundreds, if not thousands, in avoidable taxes.

Building a Smarter, Tax-Smart Protection Strategy

The goal of accident insurance should be to enhance financial security, not undermine it. Avoiding coverage out of fear of tax complications isn’t the answer—smart planning is. A tax-smart protection strategy starts long before a claim is filed. It begins with asking the right questions during enrollment: Who pays the premium? Is it pre-tax or after-tax? Is the plan integrated with other benefits? Is the payout considered income replacement or a lump-sum benefit? These details shape the tax outcome and should be documented from the start.

When reviewing policy language, apply a tax lens. Look for keywords that signal potential issues. Terms like “employer contribution,” “pre-tax deduction,” or “integrated with benefits package” are red flags that require clarification. Request a written explanation from HR or the insurer if anything is unclear. Don’t rely on verbal assurances—get it in writing. If you’re purchasing a plan independently, confirm that premiums are paid with after-tax dollars and keep proof of payment.

For those with complex benefit structures, consulting a tax professional or financial advisor is a wise step. They can review your entire benefits portfolio and identify potential conflicts. They can also help you plan for future claims, ensuring that payouts are used in a way that minimizes tax exposure. This level of foresight transforms accident insurance from a potential liability into a truly effective safety net.

Finally, treat tax compliance as an ongoing responsibility, not a once-a-year task. Update your records annually, stay informed about changes in tax law, and review your coverage during open enrollment. Financial security isn’t just about having insurance—it’s about understanding it. With the right knowledge and habits, you can enjoy the benefits of accident coverage without the hidden costs. Proactive awareness doesn’t eliminate risk, but it puts you in control—where you belong.